Operator Notes on 11.11: Our Biggest Month, and Why It Still Fell Short

A raw breakdown of our 11.11 this year. What worked, what didn’t, where we hit the ceiling, and what really happens behind the scenes when a small team chases a big day.

Hi, I’m Shan. I run Xandro Lab, a science-first longevity brand in Singapore. Every Sunday, I write about what we are building, what I am learning, and how the journey feels from the inside as someone operating at the intersection of longevity, performance, and recovery.

This week, I want to write about 11.11.

Singles Day is the one day in the year that reveals the truth about where a brand stands. All the work that happens across the year, from product development to communication to demand creation, shows up in a very honest way on this one day.

It is a strange mix of excitement and pressure. The friction for consumers is the lowest, everyone is actively looking for deals, and the willingness to spend is at its peak. If things go well, it means you did many things right in the months leading up to it. If things don’t, it means the market has already given you the answer.

For me, 11.11 this year was a complicated experience. We achieved a milestone we had never hit before — crossing 100k in a single day — and yet, it didn’t feel as satisfying as I imagined it would. The growth was there, but so was the ceiling. Some parts of the business broke, some parts surprised me, and some parts made it clear that we still have a long way to go if we want to build a truly large company. This is my attempt to break it all down: what worked, what didn’t, where we hit limits, and what I need to fix going into next year.

In this week’s note, I want to break down our 2025 Singles Day in detail: the ads that worked, the surprising behaviour around bundles, how different channels performed, the cash flow constraints that shaped our decisions, and a sincere look at where the culture and execution fell short. This is an honest operator breakdown of our biggest month so far, and why it still didn’t feel like enough.

Today’s reading:

The Ads That Carried Us

The Shock of the High-Value Bundles

Channels and Markets

The Cash Flow Crunch

The Culture, the Team, and the Comedown

1. The Ads That Carried Us

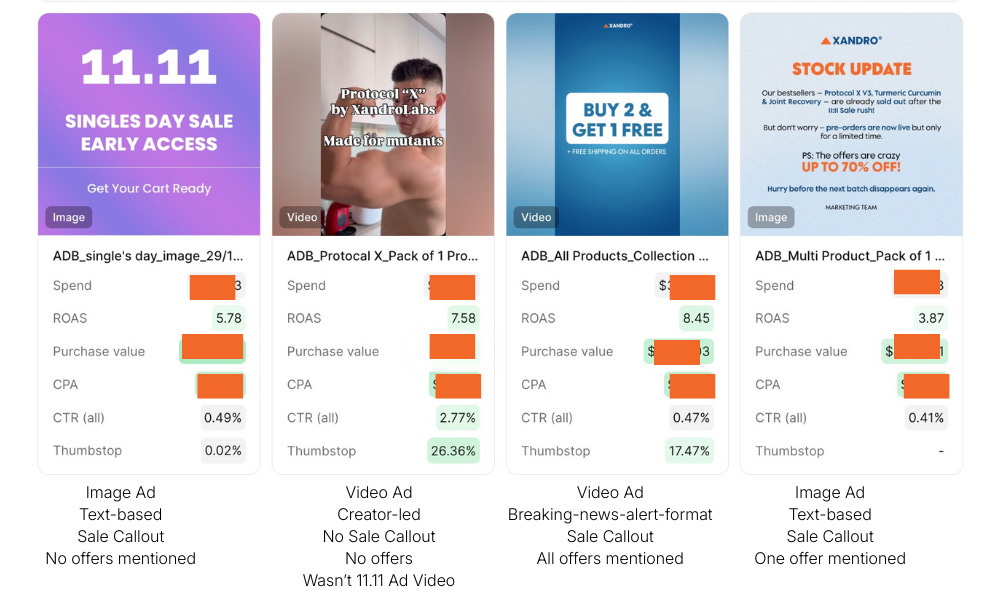

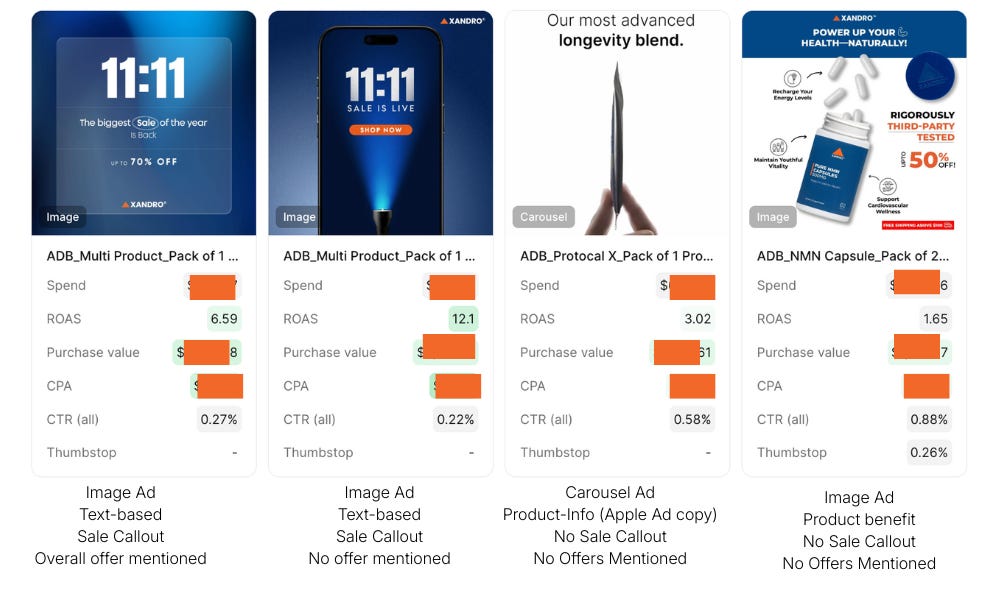

When I looked at our top-performing ads for 11.11, one thing stood out immediately. Three of the top eight ads were nothing more than the words “11.11”. No brand name, no SKU, no product image, no offer. Just the date. And they performed exceptionally well.

That is the psychology of Singles Day. People already know the deals will be good. They know this is the biggest sale of the year. When someone sees “11.11”, their intent is already high, and they click.

Early access ads also did well. Our simplest ads outperformed the more complicated ones. We could have made ten variations of the plain 11.11 ad and they would all have performed.

Another ad that surprised me was the Apple-style Protocol X ad we created months ago when the iPhone 17 launched. During 11.11, it resurfaced and became one of the strongest performers. It reminded me how cultural familiarity drives action. People recognise a format and respond.

We also had a Marvel-inspired ad from a creator — the “mutant series” — which did well entirely because it was entertaining during a period when everyone is bombarded with similar messages.

But the biggest winner was something far simpler: stock updates. When we started running out of inventory, we pushed a few “selling out fast” and “sold out” updates. These converted incredibly well. Urgency works best when it is real, and during 11.11 we could see it in the numbers. If I had pushed daily stock-update ads, I believe they would have driven even more lift.

One year-old NMN ad focusing on “rigorously third-party tested” also came back into the top tier. The lesson is clear — trust-building phrases matter, especially during high-intent periods.

Looking back, we missed founder-led ads and employee-led ads. That could have added scale.

The biggest learning: Singles Day rewards simplicity. The more obvious the ad, the better it does.

2. The Shock of the High-Value Bundles

If ads were predictable, bundle behaviour was not.

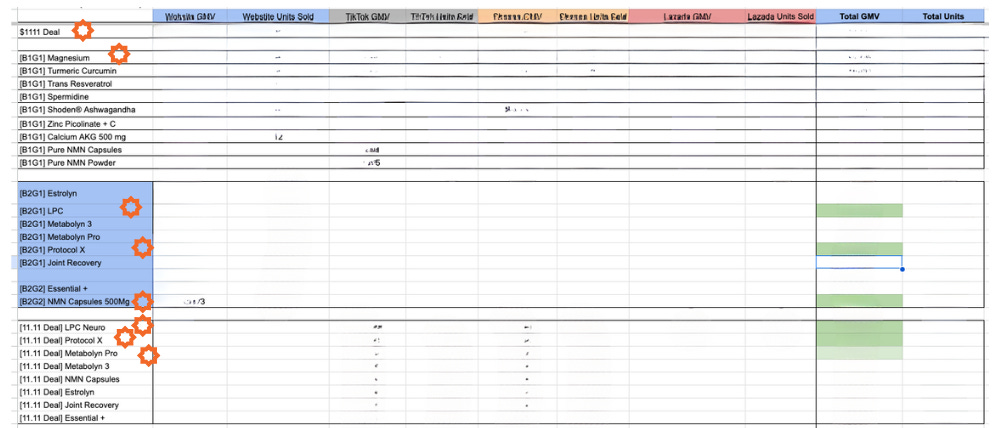

The single $1,111 mega bundle — the one I thought only a few people might buy — became the highest revenue driver. It outperformed the combined revenue of all Buy-1-Get-1 deals. It even beat Buy-2-Get-1. The only set of offers that beat it were the 11x bundles: 11x LPC, 11x Protocol X, 11x Metabolyn Pro.

This tells me something important about our audience: when people trust a product, they don’t want one bottle, they want a year’s supply.

The challenge is that new customers rarely buy these large bundles. They are almost entirely driven by existing, confident users. That means next year we will need a dual strategy — high-value large bundles for repeat customers, and simple, frictionless entry packs for new ones.

Channel placement also mattered. The 11x bundles performed incredibly well on TikTok and Shopee, but we didn’t put them on the website. That was a miss. Website users would have bought them. Meanwhile, the Buy-2-Get-1 deal was website-only, which helped differentiate but likely limited volume.

Product-wise, our top performers stayed consistent: Protocol X, LPC, Metabolyn Pro, Magnesium, Joint Recovery, and Turmeric Curcumin (driven by Hong Kong demand). Even NMN 500, one of our oldest SKUs, returned to the top list.

There was one painful learning: if a product isn’t launched by July, it will not matter for Singles Day. New products take six to seven months to mature. All six new SKUs we planned for September are now pushed to January and February. We left revenue on the table simply because the launches didn’t happen.

3. Channels and Markets

TikTok led the way, as expected, and matched October’s total revenue within the first ten days of November. But there were signs of saturation. Livestreams felt flat. We had more livestreamers this year, ranging from celebrities to doctors to singers. However, the audience did not grow. Our livestream approach was simpler — fewer user guests, fewer experimental segments, but different and credible hosts — which made operations smoother but slowed discovery. Nearly 70 percent of our TikTok buyers were repeat customers. That’s loyalty, but it’s also a ceiling.

The website, however, performed extremely well throughout the month, starting from 1 November. Much of this lift came from Hong Kong. We ran a small set of ads there, and because Hong Kong users only had the website to purchase from, all demand concentrated there. It’s not a huge market (yet), but the traction gave me confidence that Hong Kong can grow meaningfully next year.

Shopee continued to show a much healthier mix of new and returning users — almost a 50-50 split. It remains one of our most reliable channels for discovering first-time customers.

What bothered me was that business-as-usual days dipped sharply. People were waiting for 11.11 instead of buying in early November. That shouldn’t happen. A growing brand should see its BAU days lift alongside sale days. This is something we need to solve through better pacing and social hype.

In terms of new versus existing buyers:

• TikTok: mostly existing

• Website: balanced

• Shopee: balanced

• Hong Kong: almost entirely new

There is a clear message here. TikTok has hit its ceiling (not a good thing). The website and Shopee have not. However, Shopee and wesbite are not as consistent and don’t match the scale of TikTok.

4. The Cash Flow Crunch

Behind the scenes, the hardest part of 11.11 this year was cash flow.

We couldn’t produce enough inventory on time, and we didn’t have the cash cushion to run aggressive large-scale marketing or take risks in new markets. No maximum-delivery campaigns, no scaling up Hong Kong, no testing Australia or the US.

This wasn’t due to lack of revenue — August did well. The problem was the timing. Higher operating costs, higher ingredient costs, and our investments in community and offline activations meant cash was already tight. The plan was that September and October would replenish our cash for Singles Day.

Instead, both months dipped. Revenue fell. Expenses stayed high. Inventory bills were large. And we entered November with almost nothing in the bank.

We had to turn to credit terms with vendors and short-term loans. By the time 11.11 started, we had to treat every marketing dollar like it had to return immediately. We had no margin for experimental campaigns.

The sale ended up profitable, but we definitely held back on potential scale. With more cash, we could have pushed far harder.

This also made something else clear: we are hitting a ceiling in multiple parts of the business. We need to figure out which part is slowing everything down — content, funnels, product mix, production speed, or communication.

5. The Culture, the Team, and the Emotions

This year also exposed cultural and organisational gaps. People were missing during the most important weeks. Production did not fully understand the stakes and couldn’t deliver inventory on time even when ingredients were ready. The bottleneck was a mix of capacity and mindset. This is something I need to fix.

Our ads agency underperformed the entire year. D2C stayed flat. I should have intervened sooner, replaced them, or built a stronger internal flow earlier. The consolation is that we learned how to make ads ourselves, which will help next year.

There’s a deeper cultural question I keep thinking about. In my 2016–2020 days, nobody went home during big events. We stayed in the office past midnight, refreshing dashboards, changing creatives on the fly, fixing issues as they emerged, and reshaping the strategy hour by hour. The momentum came from a shared sense of urgency.

I haven’t built that culture here yet. I’m also not sure whether we should replicate that exact pace. But I do know we have more control than we think. A new ad concept can shift the energy of a sale. A surprise deal can lift a stagnant stream. Social hype can change demand patterns. And our creator and affiliate networks — both currently too small — can be built into much stronger engines.

Production remains our biggest bottleneck. The gap between forecast and output needs structural fixes — space, equipment, and people — but this will take time.

We crossed 100k in a single day for the first time, but I didn’t feel ecstatic. It felt like a number we had to fight too hard to reach. It should have come more easily. I didn’t know whether to push harder or simply let things run. I chose the latter.

That’s where we are today: a brand with momentum, hitting ceilings, learning new things, missing obvious things, and trying to build a system that can hold a much bigger future.

Closing Thoughts

When we ran out of stock in the middle of the event, I had a decision to make. Do we stop the sale completely and avoid long waiting times? Or do we continue, take limited orders, and tell users clearly that everything from that point onward would be a pre-order?

I decided to continue the sale, slowly and carefully. We informed people across channels that orders would take time, and I only allowed a limited number of pre-orders each day. Instead of scaling aggressively on the biggest day, I found myself watching inventory numbers and production timelines, trying to calculate what we could actually fulfil in the next month. It was the opposite of what a Singles Day push is supposed to feel like.

It has been almost twelve days since the sale ended and we are still fulfilling orders. We will continue fulfilling for another fifteen to twenty days. Some consumers are understandably impatient. We received a few complaints, but surprisingly, far fewer than I expected — fewer than ten so far. Clear communication helped. People appreciate transparency even when the situation is not ideal.

The real consequence of not producing enough inventory is not just the tail end of 11.11. It’s everything that comes after. Black Friday is the second biggest window of the year, and we had no stock for it. Everything became a pre-order again. We have livestreams lined up in early December with no clear idea of which products will arrive in time.

But this is also the reality of running a business. These things happen. Complaining doesn’t solve them. Fixing them does.

For now, the focus shifts to two major offline events — HYROX and the Singapore Marathon. We will be present at both. If you’re coming as a spectator or participant, come meet us. Try the products, experience the new testing kits we are rolling out for upcoming launches, and speak to the team. These events matter. They build trust in ways ads can’t.

After that, we close the year with a short break, reset as a team, and prepare for what comes next. A new year means we get to wipe the slate clean. Whatever went wrong this year stays here. Whatever we didn’t fix in time becomes the first thing we improve in January.

Next year needs to be big. It needs to be more disciplined, more structured, more creative, and more ambitious. We will overhaul production, expand the team, rebuild agency support, scale the creator network, deepen our markets, and tighten every part of the machine. There’s a lot to do, and I want to bring everyone along with me — the team, our partners, and all of you who follow along each week.

This 11.11 showed me where we stand. Next year will show what we are capable of.

That’s all for this week.

P.S. These Sunday notes help me think clearly, but I also want them to be useful for the people reading them. If there is anything here that felt unclear, too detailed, not detailed enough, or if there are parts of the business you want me to unpack in a simpler way, please tell me. If these writings are helping you understand the journey better, or if there are topics you want me to go deeper into, I would love to hear that too.

Until next Sunday. Cheers, Shan